In today’s digital era, businesses are scrambling to streamline operations, sprinkle some magic on customer experiences, and ka-ching their way to overflowing revenue streams.

Success in all areas is challenging. Particularly when you have limited workflows, the managing becomes overwhelming.

The answer to all this is a CRM system. When you align your organizational goals with your customer’s interests, you create a powerful synergy that drives customer satisfaction, fosters loyalty, and propels sustainable business growth.

Moreover, all the above objectives also revolve around a reliable purchase mechanism that is closely dependent on the CRM payment processing platform.

So, today we explore the potential of CRM Payment Integration, and how to leverage the advantage of CRM against the requirements of a robust payment infrastructure.

This read will cover…

Need for Payment Integration in CRM Systems

It will take you forever to close a deal and keep track of what was done, what you have, and how to capitalize on it. It’s not a wonder how organizations are adopting CRMs as much a part as marketing & sales are.

More so. 81% of organizations are expected to use AI-powered CRM systems to improve customer interactions.

Prevents messy work and jumping from one online payment software to another which is not how you want your payments to be. Payment processing software, accounting & book-keeping software, tracking & reporting software, and CRM software to manage everything including communication, and ERP (Enterprise Resource Planning) software. And nowadays, a reliable payment automation software.

A few more statistics indicate the success of CRM Payment Integration.

- 74% of businesses say CRM software gave them improved access to customer data.

- 39% of businesses say their upselling and cross-selling efforts improved by using CRM software.

- 46% of companies use their CRM platform to manage quote and proposal form submissions.

It gets better! In the sections below, we’ll discuss the essence of a successful payment infrastructure that is powered by CRM easily. It will be followed by how the CRM fulfills your payment infrastructure requirements.

What is required to Build a Robust Payment Infrastructure?

What tools do you require to process an online transaction and follow through? To fully accept online payments, keep track of them, and capitalize on payment data, you would typically need the following essential tools:

Payment Gateway

A payment gateway acts as the intermediary between your website or app and the customer’s payment method. Popular payment gateway providers include PayPal, Stripe, Square, and Braintree. Gateways top the charts when it comes to building a robust payment infrastructure.

CRM System

CRM systems like Zoho CRM, Salesforce and HubSpot, or custom-built solutions can be among your epic choices for this purpose. Get the hang of it and you will step up the marketing game with rich authentic data!

A CRM Payments system will allow you to store payment data and manage customer relationships. Besides invoicing and payment software, a CRM will help you keep track of customer information, payment history, communicate payment statuses, and other relevant details.

Analytics and Reporting Tools

To capitalize on payment data, you need analytics and reporting tools that provide insights into customer behavior, marketing trends, and revenue. Google Analytics, or built-in reporting features within your CRM or e-commerce platform can help you analyze payment-related data.

Accounting or ERP System

Integrating your payment data with an accounting or ERP system allows you to manage financial records, track revenue, and reconcile transactions. Tools like Xero, or other accounting software can be integrated to streamline your financial processes.

Customer Communication Tools

Communication tools such as email marketing platforms or marketing automation software help you engage with customers, and send order confirmations, payment receipts, and personalized offers. Examples include Mailchimp, HubSpot CRM’s rich automated email marketing feature, or tools integrated with your CRM system.

Data Security and Compliance Tools

Ensure data security and compliance with regulations like PCI-DSS, use tools or services that provide encryption, fraud prevention, and compliance monitoring. You can find them easily with most online payment software available in the market. These tools will give you ease to protect sensitive payment data and maintain regulatory requirements.

Customer Support and Helpdesk Software

Providing excellent customer support is crucial when you’re handling payment-related inquiries or issues. Helpdesk software like Zendesk or HubSpot Live Chat feature can assist in managing customer inquiries and ensuring timely resolutions.

Marketing and Conversion Optimization Tools

Tools that focus on marketing automation, conversion rate optimization, and customer segmentation can help you leverage payment data for targeted marketing campaigns, upselling, and cross-selling. Examples include Google Optimize, or marketing automation platforms such as HubSpot Marketing Hub.

When you can have a centralized system, managing all the above separately is folly. Moreso, you can make more out of a customer relationship and do more than just a one-time sale.

It is easier to retain a customer than to bring a new one.

Need a better HubSpot Payments alternative?

With Formpay you can collect payments in HubSpot CRM. Anywhere in the world with any gateway.

What does a CRM Payment Integration offer you?

A CRM payment processing platform offers several benefits and functionalities that can enhance your business operations. It can help you manage customer interactions for payment, streamline sales and marketing efforts, also make cross-selling & upselling easier.

So, in the section below we’ll discuss what it really has to offer.

5 Reasons Why You Must Have CRM Payment Integration

Improved Data Analysis for Informed Business Decisions

Growth opportunities for every business reside inside its data, especially payment data. The more you look for in your already existing data, the more insights you obtain.

Meanwhile, CRMs store payment data. Besides getting automated payment processing software, you get to automate invoicing processes, share payment statuses, resell, and cross-sell. Think how much effort it would require if you do it manually. Close to impossible.

Personalization Based on Customer Purchase History and Behavior

Payment data in your CRM, when analyzed alongside other operational data, can offer valuable business insights.

By correlating payment data with customer behavior, marketing campaigns, or product performance, organizations can identify trends, uncover business opportunities, and optimize their operations.

And so, you’ll identify new market segments, optimize pricing strategies, or refine product offerings.

Simplified & Safe Payment Process with No Manual Input

Payment data enables swift payment processing, reducing friction in the checkout process. This leads to an enhanced overall customer experience, increased customer satisfaction, and loyalty.

By collecting and securely storing payment data, organizations can offer customers the flexibility to choose their preferred payment method, making the transaction process more convenient and accommodating. You can also enable one-click or express checkout options.

The payment data also plays a crucial role in detecting and preventing fraudulent activities. Moreover, you can use the data to simplify the process of reconciling transactions and managing accounting records.

Enhanced Visibility and Streamlined Operations

Accurate and detailed payment data enables organizations to track revenue, reconcile financial statements, and generate reports necessary for auditing, tax compliance, and financial planning.

For example, organizations can identify bottlenecks in the payment process, such as high cart abandonment rates or delays in payment verification. By analyzing payment data and identifying areas for improvement, organizations can streamline processes, reduce friction points, and enhance operational efficiency.

Faster collection of payments and improved cash flow

Payment data simplifies the process of reconciling transactions and managing accounting records.

Organizations can gain a clear understanding of their cash flow, revenue trends, and customer purchasing behavior. This information can help businesses make informed decisions regarding pricing, product offerings, and marketing strategies.

CRM Payment Processing Compatibility & How to Overcome Challenges

Overcoming challenges and maximizing profitability when you employ a CRM payment integration.

- Research CRM and Payment Processor Integration Options: Look for supported features like payment data synchronization, transaction tracking, and order management.

- Assess API and Plugin Capabilities: Look for features such as secure data transmission, real-time synchronization, and support for transaction management.

- Understand Payment Data Flow: Determine if the CRM system acts as a pass-through for payment data, where transactions are processed directly by the payment processor, or if the CRM system handles some aspects of the payment process itself.

- Ensure Payment Data Security: Ensure that the CRM system and the payment processor comply with industry standards and regulations, such as Payment Card Industry Data Security Standard (PCI DSS) requirements.

- Test Integration and Compatibility: Ensure compatibility, functionality, and data synchronization between the systems. Test various scenarios, such as processing different types of transactions and verifying that payment information is accurately recorded within the CRM system.

- Consider Custom Development: In some cases, custom development may be required to achieve the desired level of compatibility with the payment processing platform. Engage with experienced developers. This may involve developing custom APIs, plugins, or scripts to bridge any compatibility gaps.

- Stay Updated with CRM and Payment Processor Updates: Both CRM systems and payment processors regularly release updates, bug fixes, and new features. Stay informed about these updates to ensure ongoing compatibility between the systems.

Popular CRM Payment Integration

Following are the popular CRMs that offer payment integration. So here’s the CRM payment integration that you may consider and below are discussed their potential, targeted users, and extent of integration.

New Breed Revenue

- HubSpot – HubSpot CRM offers payment integration through HubSpot CRM Payments feature. It enables businesses to create and send invoices, track payment statuses, and securely process payments using Stripe payments as the payment gateway.

- Salesforce – Salesforce is a leading CRM platform that offers CRM payments integration capabilities through its Salesforce Commerce Cloud and Salesforce Billing products. It allows businesses to accept payments, manage billing cycles, and integrate with various payment gateways.

- Zoho – Zoho CRM provides payment integration functionality through its Zoho Books and Zoho Invoice modules. It provides businesses with invoicing and payment software, processes online payments, and track payment history within the CRM system.

- Microsoft Dynamics – Microsoft Dynamics 365 too has CRM payments integration capabilities through its Sales and Commerce modules. It allows businesses to manage customer relationships, create quotes and orders, and process payments using various payment gateways.

How MakeWebBetter can ease up CRM Payment Integration?

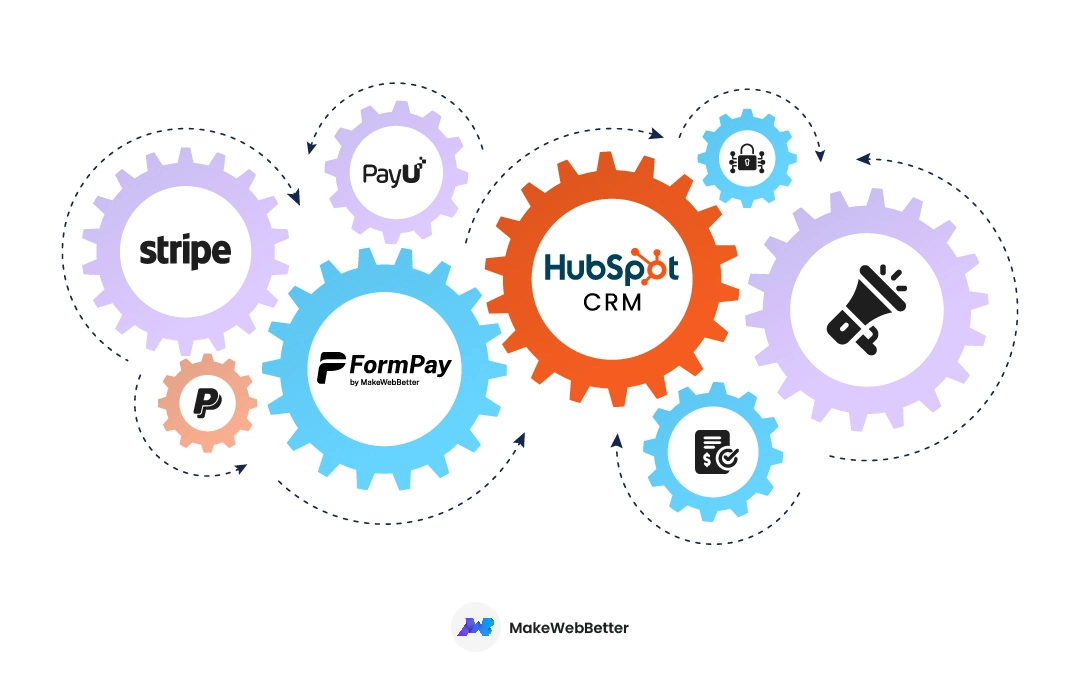

FormPay by MakeWebBetter is emerging as the leading solution for CRM Payment integration in the market, specifically when it comes to payment automation software and monitoring. MakeWebBetter currently holds the esteemed status of being a HubSpot Elite Partner.

Furthermore, this HubSpot connector serves as a convenient HubSpot billing integration, seamlessly integrating with Xero to maintain accurate accounting records and offering a payment reconciliation feature.

Additionally, FormPay simplifies reporting and analytics by collaborating with Microsoft Clarity and Google Analytics. This means that users can easily access valuable insights and generate comprehensive reports on payment activities using the no code HubSpot integration.

FormPay brings a wide array of renowned payment gateways, including PayPal, Stripe payments, Amazon Pay, Razorpay, PayU, and Adyen. This means, the HubSpot connector facilitates cross platform integration. Moreover, you have the freedom to choose the payment gateway that best suits their needs. Moreover, you can deploy multiple gateways using this HubSpot connector.

Even better, if you’re currently employing HubSpot’s free version can leverage FormPay to receive payments anywhere in the world.

Sell and accept payments anywhere in the world. Use FormPay!

FormPay allows you to accept payment using your preferred payment gateways through HubSpot Forms.

Features of FormPay That Stand Out

Auto-Segmentation With Payment Properties – The data sync also results in the RFM segmentation of data, hence created as special payment properties in your HubSpot account. These properties can be utilized to create custom lists, assign workflow triggers, and create reports based on real-time data.

Accounting With Xero Integration – Using this HubSpot connector you can even facilitate accounting software ‘XERO’ integration by its side. The integration helps mapping your financial data to the chart of correct accounts. This also allows you to maintain financial records, track revenue, and reconcile transactions.

Automated Invoicing with Tax Calculation– FormPay with HubSpot enables you to obtain automated invoices and distribute them with ease using the efficient HubSpot workflows. Moreover, VAT calculation is one salient feature of FormPay, that reduces effort.

Full-Fledged Donation Settings – Nonprofits need CRM more than anything. It’s crucial for them to build relationships with their donors. Accept recurring payments (donations) and get all the settings related to donation form creation enabled with just a toggle.

Tracking with Full Control and Multiple Users – Every payment form, coupon, or product you create is easily trackable and reusable. You get built-in features for tracking coupons & products, payment form submissions, and transactions performed using the form are also traceable with status and all the information.

Rich Reporting & Analytics Tools – Integration with Google Analytics and Microsoft Clarity powers FormPay to extract valuable data. These insights can help you with monitoring customer behavior, discover sales trends, and overall revenue.

Multiple Payment Gateways & Currency – Adyen, Amazon Pay, Apple Pay, Google Pay, Razorpay, Stripe, PayPal, and PayU, are among the popular payment gateways that you can leverage at FormPay. Besides this, the FormPay team also welcomes you to request your favorite payment gateway. You can employ your native currency to accept payments all over the world.

Benefits of Setting Up CRM Payment Integration Through FormPay

Automated Payment Processing – If you throw caution to the wind and forgo a seamless automated payment processing software, then it will be a lag. Integration of CRM Payments will get you the customer experience that you want to obtain and this sure will save you everything to focus on better opportunities.

Effortless Data Automation – All your payment data along with customer information is synced into HubSpot CRM for you to utilize for marketing and communication purposes. Besides saving you a lot of time and reducing the risk of errors, this also serves for improved data integrity and helps you focus on more strategic tasks.

Much Needed Workflows – FormPay syncs the data and HubSpot gives you everything to talk your buyers through their buyer’s journey. The rich payment data accumulated can also be purposed for upselling, cross-selling, targeted marketing campaigns, and abandoned cart recovery through HubSpot workflows.

Propelled Marketing Efforts – The facility through which you can give your buyer to avail coupon discounts. Moreover, you get to create product-specific forms. This simply means specific products that have coupon discounts available can be promoted with coupon marketing campaigns. This means, this HubSpot connector adds value to your email marketing efforts too.

Data Security – You get added encryption and security features with FormPay, besides the payment data safety promised by payment gateways. All payment gateways used are compliant with Payment Card Industry Data Security Standard (PCI DSS) & Payment Application Data Security Standard (PA-DSS). The app servers have SSL encryption and FormPay is also GDPR compliant.

Got Questions?

Find more help understanding the FormPay app through these links.

Closing Remarks

Deciding the right integration can be challenging, just look for the above features and the more compatibility you can find.

After setting up a CRM payment integration with FormPay, you will be able to streamline and automate CRM payment processing. You will be able to ensure data security with the right compliance and have centralized management for payment gateways and transactions.

The existing part is the rich data that you can leverage for the ultimate features of the HubSpot CRM including marketing automation. So, cheers on that.

| Schedule a Call | Resources | Contact Us |

Excellent post! The detailed explanation of CRM payment integration is insightful and practical. This is incredibly useful for businesses.

Informative guide! Explains CRM payment integration effectively. Valuable resource for businesses aiming to streamline their payment processes seamlessly.