Payment gateways are a necessity for every B2B business.

Without a payment gateway, it’s almost impossible to have online transactions at your store.

But which gateway is the best? What type of payment gateway should I use? Which is the cheapest one?

This post will answer all such questions.

Let’s dive right into it.

What Are Payment Gateways?

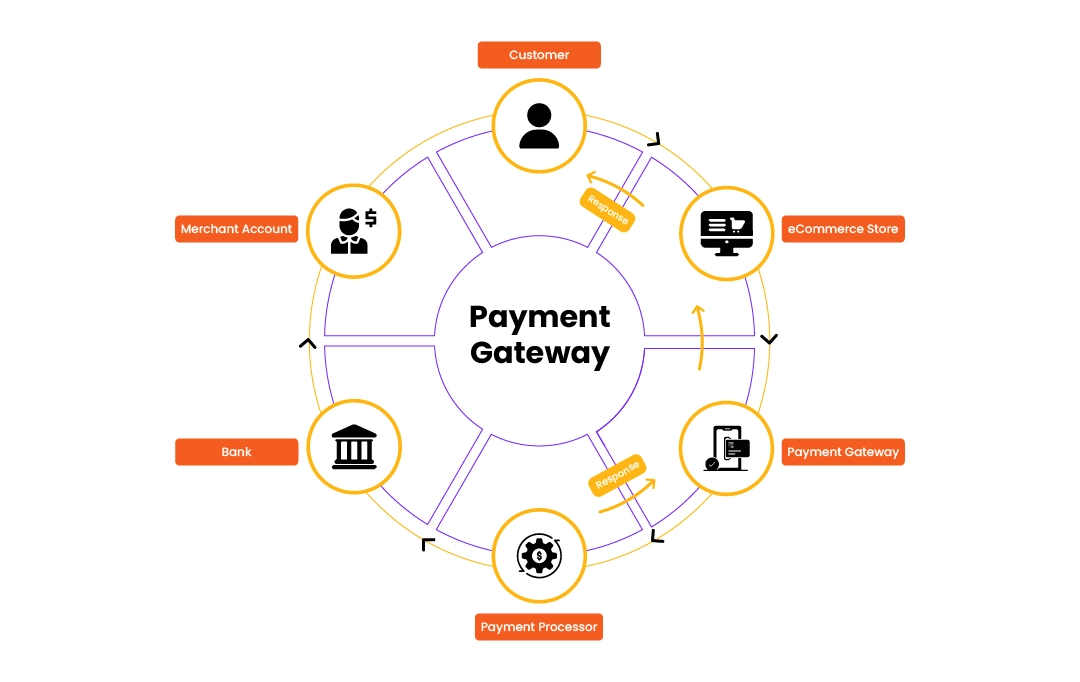

A payment gateway is a system that lets you accept payments at your online store.

Compared to traditional payment methods like cash or bank transfer, payment gateways offer a smooth checkout experience to customers.

You can consider payment gateways as a middleman between the customer’s and merchant’s bank accounts.

This middleman has the job to check if the customer has sufficient funds, authorizing and executing a safe transaction and ensuring the merchant receives the payment securely and successfully.

Let’s dig deep into payment gateways and learn more about them.

3 Different Types of Payment Gateways

Commonly, there are three types of payment gateways. Let’s discuss each of them.

-

Hosted Payment Gateways

Hosted payment gateways are those which redirect customers from the merchant’s website to the payment portal to complete the transaction.

PayPal is a good example of a hosted payment gateway.

If you checkout on a website that uses PayPal, you’ll be sent to PayPal’s payment page to complete the transaction.

You can then complete the payment from your PayPal account and once your transaction is done, you’ll be back again to the merchant’s website.

In hosted payment methods, merchants do not have control of the transaction’s data, and user experience since it happens on a different page.

But on the contrary, hosted gateways are easy to set up and don’t require you to develop and design an entire payment portal.

Anyone can get these B2B payment platforms up and running in no time.

-

Self-hosted Payment Gateways

Self-hosted payment gateways allow users to complete their transactions on the merchant’s website itself.

The best example of a self-hosted payment gateway is Stripe.

If you transact on a Stripe powered online store, you can add your card details and checkout from within the store. No need to go to a different page.

With self-hosted gateways, merchants have more control over the user experience as the transaction takes place on their own website.

The user can simply enter their card details on your checkout page. These details are then encrypted, processed and sent to the payment gateway for authorization.

But all of this happens in the backend so you don’t need to jump to another page to complete your payment.

Self-hosted payment methods eliminate the step of moving to a new page to complete the transaction. And the fewer steps in the checkout process, the better the user experience would be.

-

API-hosted Payment Gateways

API or Application Programming Interface connects and lets two different platforms communicate with each other. Here, it is the merchant’s website and the payment gateway.

With the API-hosted payment gateways, the payment details are entered and processed on the merchant’s website through the payment gateway API.

API-hosted payment methods are the best option when you want to have full control of the payment process or set up a mobile payment system.

According to reports, 3 trillion dollars would be the mobile payment market size by 2024.

Almost all gateways come with their payment gateways API, which you can use to integrate at your online B2B store.

But since you have all the control over transactions in this case, your website must possess an SSL certificate and it should be PCI DSS compliant.

Best B2B Payment Gateways in the Market

Let’s see some best B2B payment gateways available in the market.

-

PayPal

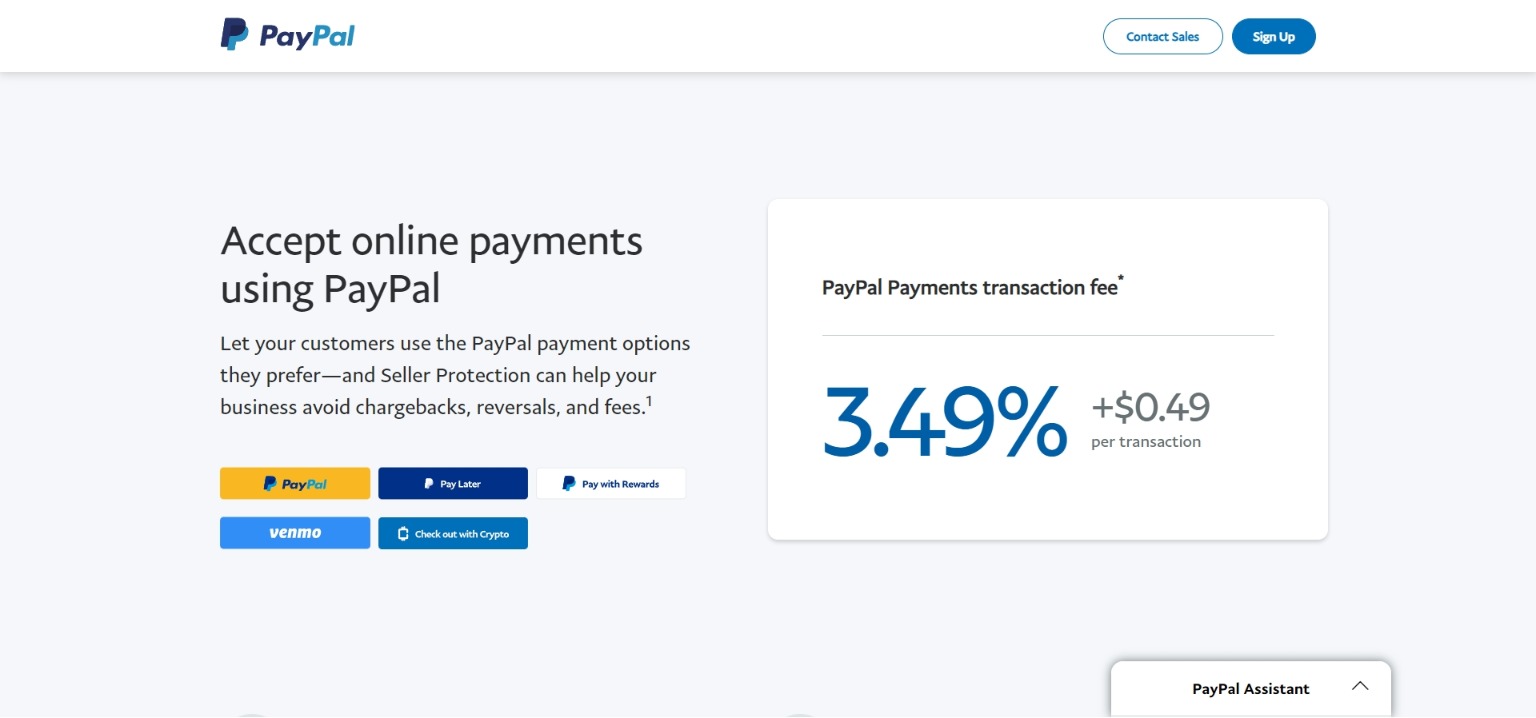

If we talk about B2B payment platforms, forgetting PayPal would be a crime.

PayPal is the most popular and trusted payment method in the market. With 60.18% of the market share, PayPal rules the global kingdom of payment gateways.

It’s a hosted payment gateway that works in 200+ countries supporting all the major cards like Visa, Mastercard, American Express, Diners and more.

Transaction processing fee: 3.49% + fixed fee(varies for every country)

-

Stripe

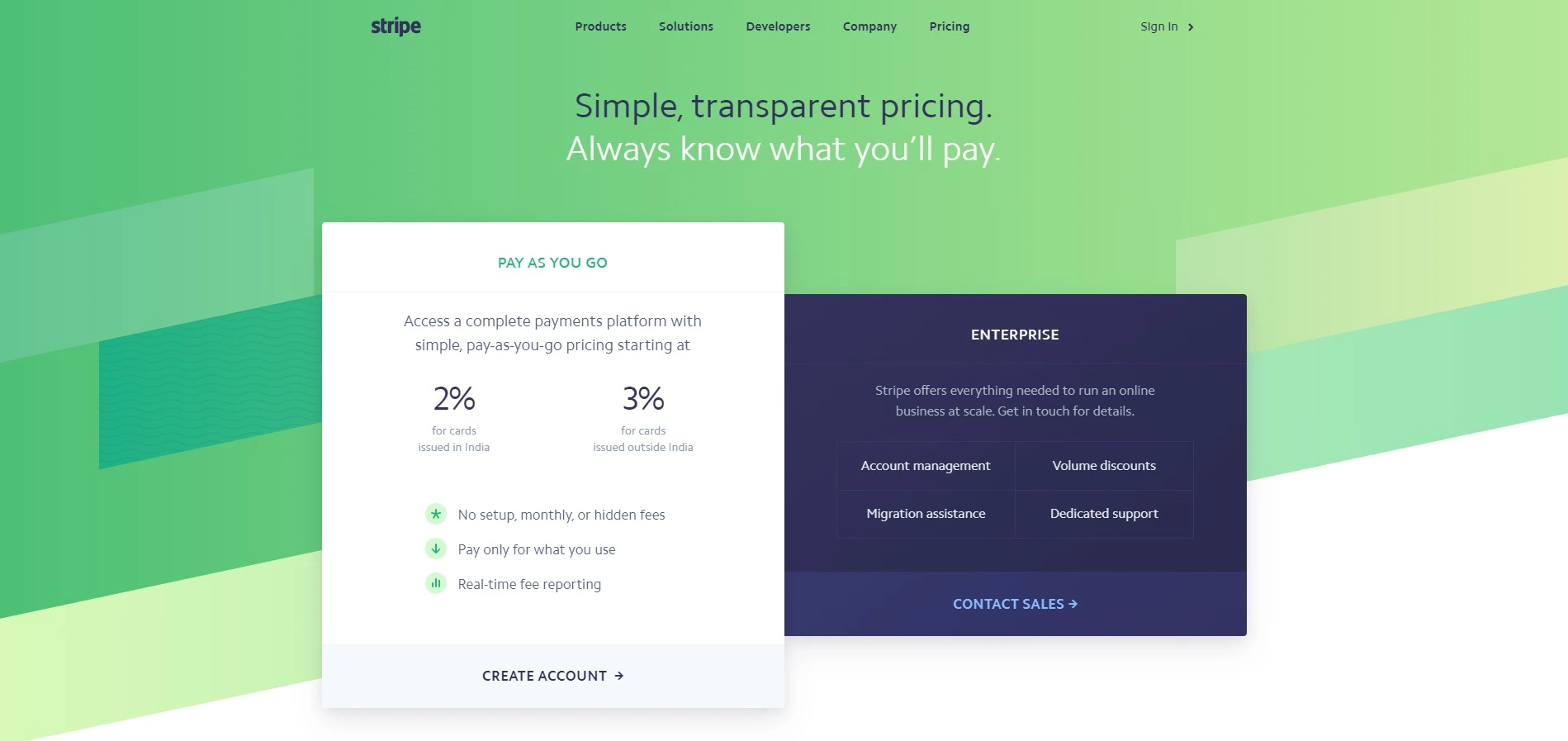

Stripe is another great choice among all B2B payment gateways.

It has the second largest share in the payment gateway market, about 16%.

Stripe is a self-hosted payment method that allows customers to pay from within the merchant’s website.

Available in 47 countries, Stripe supports over 135 currencies and works with major card brands like Visa, Mastercard, American Express, JCB and others.

Transaction processing fee: 2.9% + $0.30

-

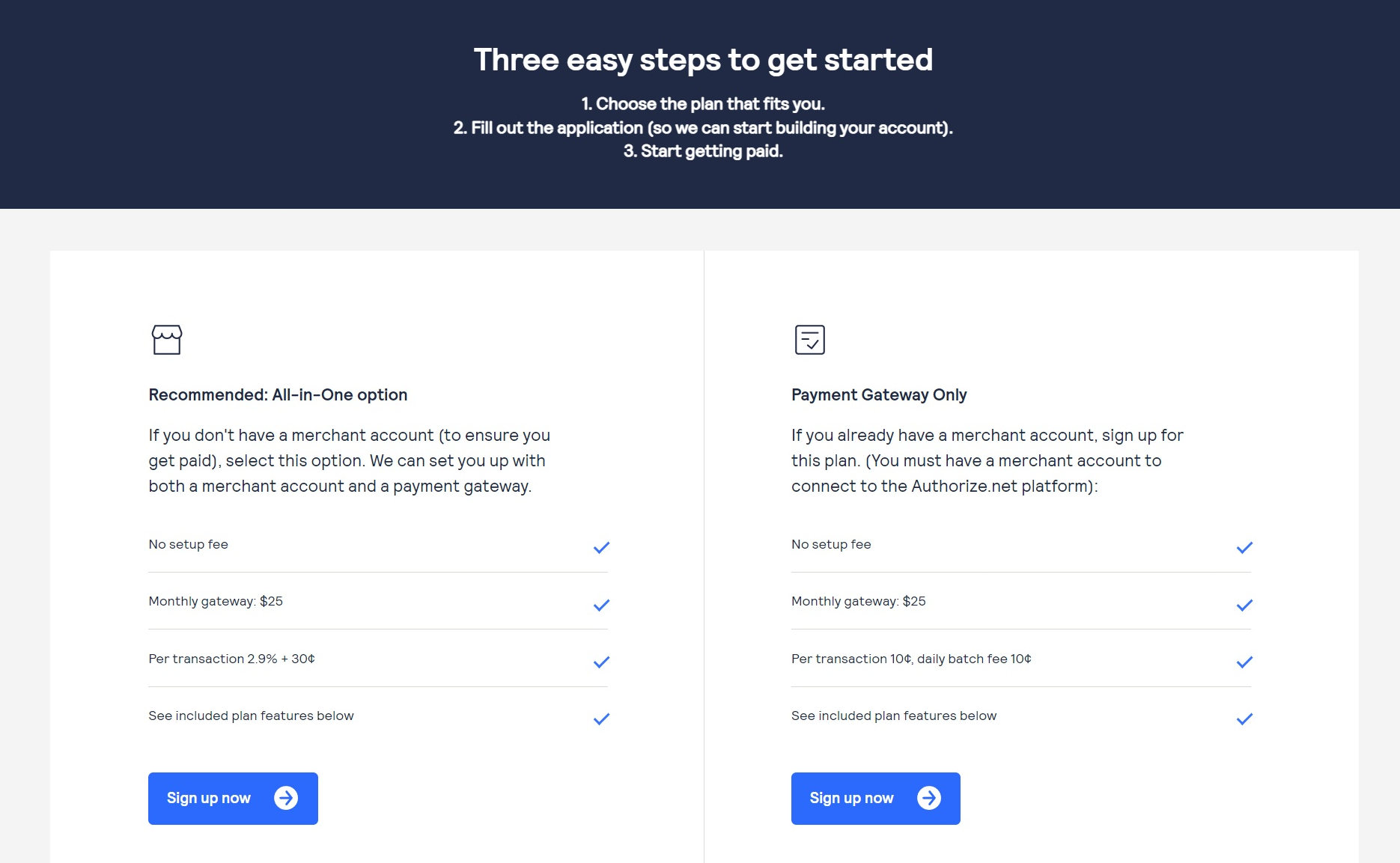

Authorize.net

Authorize.net has a 1.09% of share in the payment gateway market.

It supports many payments like eCommerce, Point of Sale, Mobile payments, eCheck and more.

Owned by Visa, Authorize.net operates in over 30 countries and supports major currencies like USD, EUR, and more.

It’s also one of the oldest payment methods around and since it’s been there in the market for a long, it has established a wide user base of over 430,000 merchants around the globe.

Transaction processing fee: 2.9% + $0.30 (All-in-one Option) | $0.10, $0.10 daily batch fee (Payment Gateway Only)

-

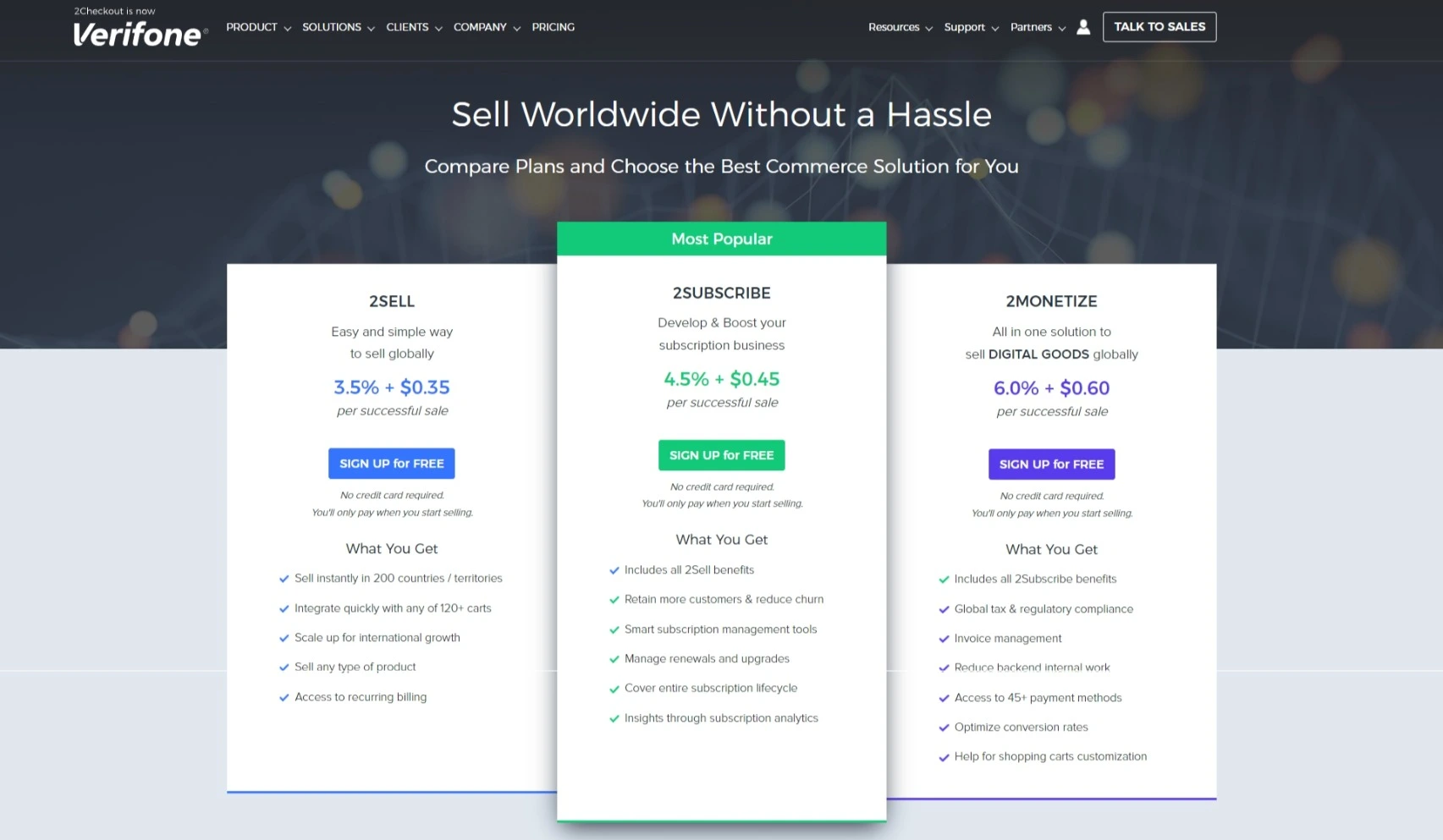

2Checkout now Verifone

Another popular B2B payment gateway in this list is 2Checkout, now known as Verifone.

Verifone is available in over 200 countries, supports 30+ languages and is compatible with over 100 currencies.

All of this makes Verifone a trusted and easy platform, especially when you’re looking to target a nation-specific audience.

It offers three different plans. The fee for every plan is written below.

Transaction processing fee:

- 3.5% + $0.35 (2 Sell)

- 4.5% + $0.45 (2 Subscribe)

- 6.0% + $0.60 (2 Monetize)

-

Amazon Pay

Amazon Pay needs no introduction.

It has a market share of 3.51%, the third largest after PayPal and Stripe.

Amazon Pay comes as a great digital wallet option since it already has a wide customer base of over 300 million users. Those who use Amazon could pay directly through their wallet easily.

And since it is a popular payment method, there are plenty of integrations available for this gateway, making it easy to connect your online B2B store with the gateway.

Transaction processing fee: 2.9% + $0.30

-

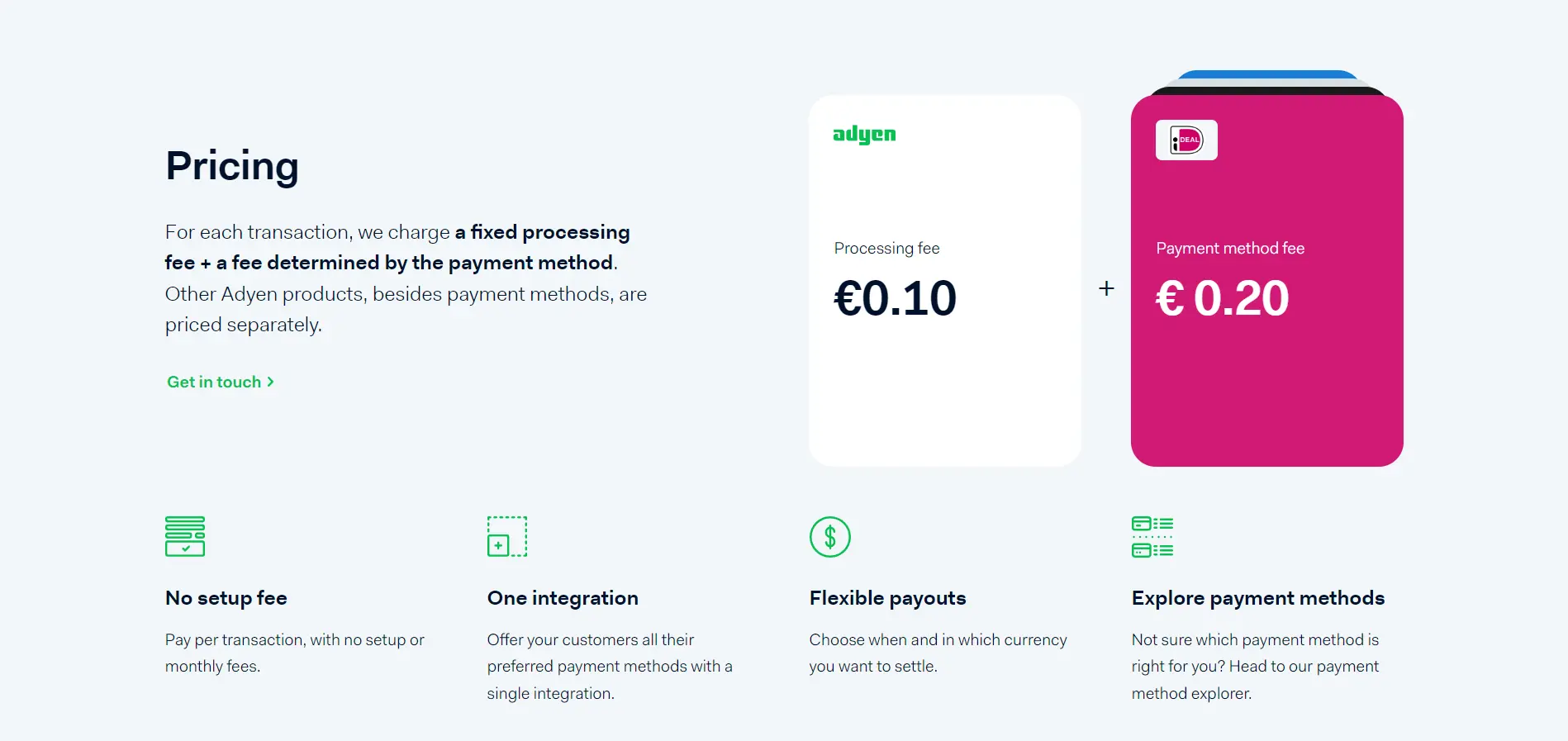

Adyen

Adyen is another amazing payment gateway for B2B businesses.

It’s used by the market giants like Uber, Spotify, McDonald’s, eBay, Wix, etc. and is compatible with many major payment methods.

There isn’t any setup fee for Adyen and it integrates with numerous payment methods. Adyen is available in 37 countries for now and supports various payout currencies.

Transaction processing fee: $0.12 + payment method fee

-

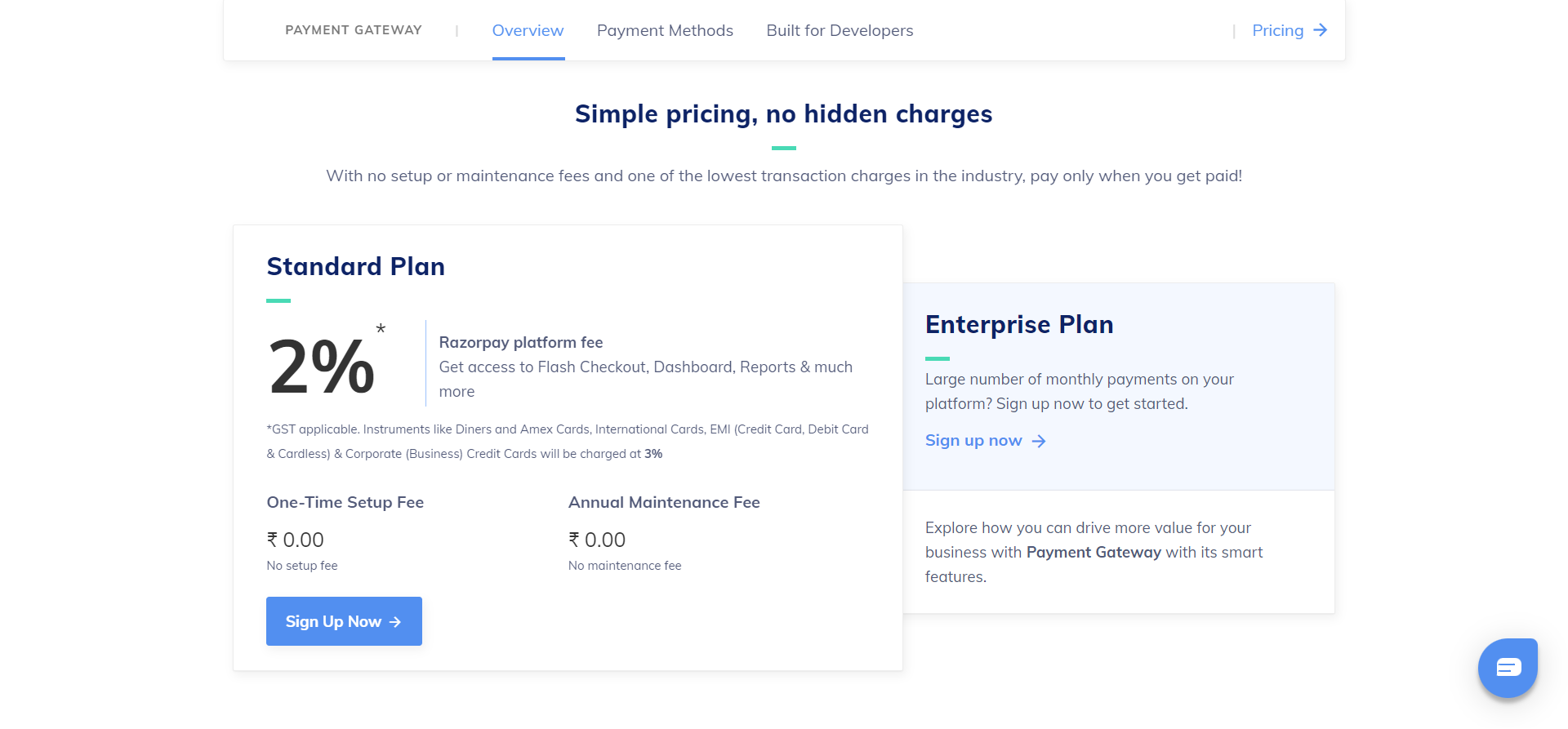

Razorpay

More than 5800 websites use RazorPay as their payment solution. And it is one of the major B2B payment platforms, especially in India.

Razorpay is used by market giants like Disney+ Hotstar, Facebook, Intuit, Zoho, and more. It also offers multiple payment features like Flash checkouts, international payments and more. Thus, Razorpay can become a great B2B payment gateway for your business.

With Razorpay, you don’t need to pay any setup or annual maintenance fee.

Transaction processing fee: 2% on all transactions

Want these payment gateways in your HubSpot CRM?

Try our FormPay app to accept payments with HubSpot forms via these popular B2B payment solutions.

Things to Keep in Mind When Choosing A B2B Payment Gateway

Before choosing a B2B payment platform, there are some things you need to consider.

Let’s talk about them.

-

Location of Your Audience

The first thing to look at while choosing the right B2B payment solution is where your target audience is located.

If your business operates in a single country, India, for example. In this case, using a UPI (Unified Payments Interface) would be the best option for your business, since that’s the most popular payment method in India.

Despite the large market share of Stripe or PayPal, you can avoid them in this case and use the option best suited for your audience.

-

Payment Process

As we discussed earlier, there are 3 types of payment gateways. Hosted, self-hosted and API-hosted.

You need to decide what’s more convenient for you and your customers.

If you want to redirect customers to a secure and trusted payment page, you can use PayPal.

But if you want to make onsite and mobile payments smooth for your customers, using a payment gateway API could be the apt B2B payment solution for you.

-

Payout Speed

After the successful payment, the gateway takes some time to deposit the money into the merchant’s account. This time is called Payout time or Payout speed.

And that’s what you should look for while selecting your B2B payment solution.

For example, the bank account transfer with PayPal takes 1 to 5 business days. While the Debit or Credit card payouts happen in minutes.

If you’re jamming for a gateway, payout speed is the factor you should definitely look at.

-

Pricing

The biggest point of consideration for any payment gateway is pricing.

Every gateway has a different fee structure. There is a set up fee, transaction fee, integration and many other fees in a gateway.

Adyen, for example, charges $0.12 as a processing fee in the United States.

So sit down on a chair and compare the fee structure for different B2B payment software on a spreadsheet to find out the best option for your needs.

-

Multi-currency Transactions

This one could be important for you if you’re operating at a global level.

Multi-currency transactions let users checkout in their native currencies.

So if your audience is global, go with a B2B payment software that enables transactions in every currency.

-

Security

Last but not least. Security is the biggest factor for customers when transacting on your website.

So if you’re choosing a B2B payment software gateway, check if that method is PCI DSS compliant.

Payment Card Industry Data Security Standard or PCI DSS in short, is a set of policies every payment gateway should comply with.

So check if the gateway you’re putting your finger at is PCI DSS compliant and how secure the transactions would be with them. Choosing a secure B2B payment gateway would encourage your customers to always complete their transactions.

What’s The Best Payment Gateway for B2B Business?

That’s a dilemma for every B2B business.

Selecting a perfect payment gateway for B2B businesses may require brainstorming.

Hence, to make things easier, I’d say, you need to first understand your own requirements and capabilities.

- If you’re someone who doesn’t want to handle payment-related activities, and leave it to a trusted B2B payment solution, a gateway like PayPal could be the best option for you.

- If you’re someone who wants to customize the checkout experience and eliminate the redirection step for transactions, a gateway like Stripe can work for you.

- Lastly, if you want to take full control of the transactions and you’re focusing on mobile payments, you can integrate any payment method using their payment gateway API.

Common FAQs About B2B Payment Gateways

There are several questions people ask about B2B payment gateways, so I’ve tried to answer some of the most common ones here.

Which is the best payment gateway for B2B stores?

We’ve already contemplated this, though. But let’s settle this query for one last time. The best B2B payment platform is the one that fulfills your business needs perfectly.

If you don’t want to handle the payments, you can go with PayPal. But if you want to take control of your payments, go with a self-hosted gateway like Stripe or use a payment gateway API.

Thebalancesmb created a comprehensive blog post ranking some of the best payment gateways for different sorts of businesses. You can check it to get a better idea.

What are some famous payment gateways?

Some of the most popular payment gateways are:

- Authorize.Net

- Stripe

- PayPal

- Square

- Braintree

- WePay

- 2Checkout (Now Verifone)

- Skrill

- Apple Pay

What is the difference between payment gateways and payment processors?

Payment gateways encrypt, authorize, and transfer the payment details to the payment processor.

Payment processors verify and transmit these details from the customer’s bank to the merchant’s bank to facilitate the transaction.

Once the transaction is facilitated, it reverts to the gateway that shows if the transaction was successful.

Which payment gateway is the cheapest?

Among all the payment methods, Stripe and Amazon Pay are the cheapest ones. They offer the lowest transaction fee, which is 2.9% of the transaction and a $0.30 fixed fee.

Over to You

Payment gateways are essential for any B2B store.

While choosing the best one for your business(which I’ve told you how you can) you need to make sure it fits your business needs, is secure, has the optimal payout speed, and makes transactions easy for the native audience.

What payment do you use for your business? Or do you have some other questions about B2B payment gateways?

Write them down in the comments section.

Want to connect with me? Follow me on LinkedIn.

Great insights on eCommerce payment gateways! Your tips are helpful for choosing the right options to enhance customer experience. Well done!

Enlightening article, It offers a comprehensive overview of eCommerce payment gateways! I really like how you’ve discussed the different types available with their unique features. The tips on selecting the right gateway for different business needs are extremely useful, especially for those who just starting out. Thanks for putting all the detailed information together.

Insightful analysis! Explores various e-commerce payment gateways comprehensively. A valuable resource for businesses optimizing their online transactions. Well done!

The insights you’ve shared about Malaysia’s thriving payment gateway landscape are enlightening! It’s fantastic to see the growth and opportunities available. Your recommendation of Go Mobi as a reliable service provider in this space is incredibly helpful for businesses. Thank you for spotlighting this excellent option for smoother payment processes!”

Great article on payment gateways! It’s so important for businesses to choose the right payment gateway to ensure smooth and secure transactions. Your breakdown of the different types of payment gateways and their pros and cons was really helpful. I particularly liked how you highlighted the importance of considering customer preferences and ease of use. Thanks for sharing your insights!

Thanks for the appreciation Osman.

Good information as an eCommerce store owner information like this really helps thanks alot!.

Thanks so much. I’m glad you liked the post.